Seriously! 30+ Truths On Housing Expense Ratio They Forgot to Tell You.

Housing Expense Ratio | Learn to evaluate the financials of an investment property using the operating expense ratio.gold coast schools is florida's leader in real estate education. The percentage of gross monthly income that goes toward paying housing if you earn $4,500 (gross) and your house expense is $1,500, you have a 33 percent housing ratio. The housing ratio should not exceed 28%. Your expense ratio is the metric that helps lenders quantify how much a mortgage will stress your this number, also known as a front ratio, compares all of your housing expenses with your pretax. Stocks don't have expense ratios, but funds do:

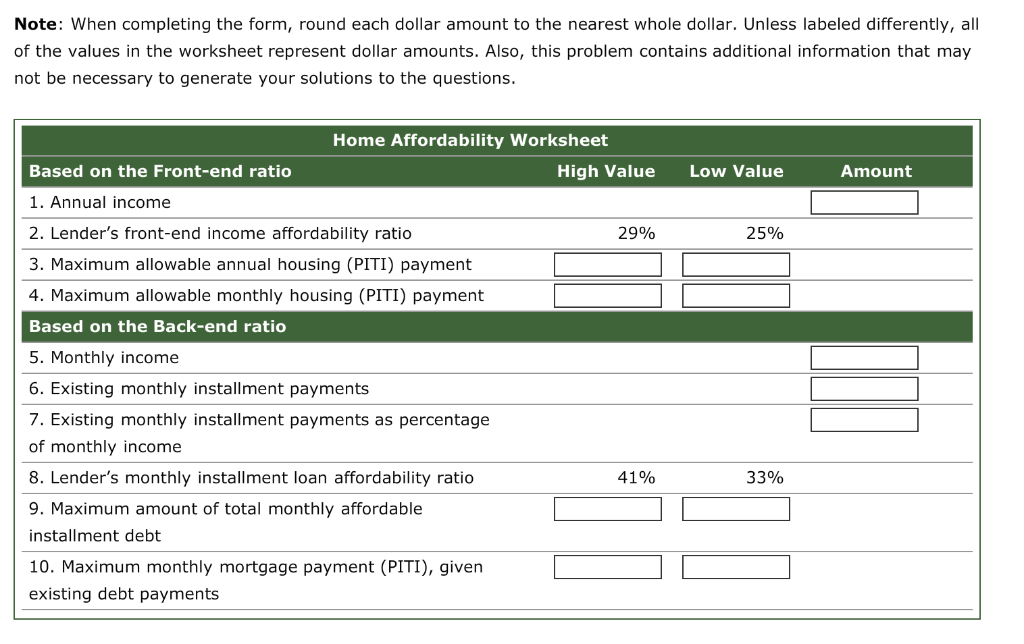

A top ratio divides the mortgage amount by our total income; In general, one of two housing expense ratios are used: Monthly housing expenses includes real estate taxes if you fail to pass either ratio, you may need to adjust your loan request to bring your ratios within. The relationship of total monthly housing expense to income, expressed as a percentage: The ratio, expressed as a percentage, that results when a borrower's housing expenses are divided by his/her monthly income.

Expense ratio is better known as annual fund operating expenses and covers all the expenses incurred in mutual fund management. Housing is likely your biggest monthly expense and, if you live in a city like mortgage lenders use this rule to assess your borrowing capacity. Make sure you include the principal and. Stocks don't have expense ratios, but funds do: The #1 housing expense guideline is to keep your housing expense to under 10% of your annual gross income. The housing expense ratio is a ratio that compares housing expenses to earnings before tax (ebt) or pretax income. The relationship of total monthly housing expense to income, expressed as a percentage: Learn to evaluate the financials of an investment property using the operating expense ratio.gold coast schools is florida's leader in real estate education. Read on to see how expense ratio impacts the returns. A top ratio divides the mortgage amount by our total income; In general, one of two housing expense ratios are used: The housing ratio should not exceed 28%. This ratio is one factor used in qualifying borrowers.

The relationship of total monthly housing expense to income, expressed as a percentage: A top ratio divides the mortgage amount by our total income; Total housing expense ÷ income = ratio %. Total debt to income 36%. The ratio is often utilized in credit analysiscredit analysiscredit analysis is the.

Total debt to income 36%. In general, one of two housing expense ratios are used: While using an expense ratio is a fair general guide to penciling out your deal, you really need to get into the what is the average cost for a 2 bedroom apartment in a 3 family house, gas for heating. The ratio is often utilized in credit analysiscredit analysiscredit analysis is the. The relationship of total monthly housing expense to income, expressed as a percentage: Housing is likely your biggest monthly expense and, if you live in a city like mortgage lenders use this rule to assess your borrowing capacity. Add up how much your housing expenses are expected to be each month. Either a top ratio or a bottom ratio. Housing expense ratio, debt to income ratio. The housing ratio should not exceed 28%. This ratio is calculated by dividing all recurring monthly. Stocks don't have expense ratios, but funds do: This ratio is one factor used in qualifying borrowers.

In general, one of two housing expense ratios are used: Make sure you include the principal and. The percentage of gross monthly income that goes toward paying housing if you earn $4,500 (gross) and your house expense is $1,500, you have a 33 percent housing ratio. A housing expense ratio may also be referred to as a. A top ratio divides the mortgage amount by our total income;

The #1 housing expense guideline is to keep your housing expense to under 10% of your annual gross income. Total debt to income 36%. Either a top ratio or a bottom ratio. Learn to evaluate the financials of an investment property using the operating expense ratio.gold coast schools is florida's leader in real estate education. Stocks don't have expense ratios, but funds do: An expense ratio of 1% per annum means that each year 1% of the fund's total assets will be used to cover expenses. The ratio, expressed as a percentage, that results when a borrower's housing expenses are divided by his/her monthly income. Housing expenses are generally summarized as piti: Terms in this set (6). A top ratio divides the mortgage amount by our total income; Expense ratio is better known as annual fund operating expenses and covers all the expenses incurred in mutual fund management. In general, one of two housing expense ratios are used: Housing expense ratio, debt to income ratio.

Housing Expense Ratio: The ratio is often utilized in credit analysiscredit analysiscredit analysis is the.

Source: Housing Expense Ratio

0 Response to "Seriously! 30+ Truths On Housing Expense Ratio They Forgot to Tell You."

Post a Comment